REGULATORY UPDATE: Brazilian Central Bank Issues Regulatory Framework on Virtual Asset Service Providers

On November 10, 2025, the Central Bank of Brazil (“BCB”) released Resolutions BCB Nos. 519, 520, and 521, creating Brazil’s first comprehensive regulatory framework for virtual asset service providers.

The new rules stem from the BCB’s ongoing dialogue with market participants following the enactment of Law No. 14,478 of December 21, 2022, which granted the BCB regulatory authority over virtual asset activities, and from the review of more than one thousand submissions received during Public Consultations Nos. 109, 110, and 111 (the “Public Consultations”).

This new framework officially brings crypto-asset operations into the Brazilian Financial System, introducing licensing requirements, operational standards, and compliance obligations similar to those applicable to financial institutions, payment institutions, and foreign-exchange market participants.

Our team followed the BCB’s press conference¹ and prepared this alert with the key highlights:

1. Concepts applicable to virtual asset services and entities;

2. The authorization process for virtual asset service providers;

3. The treatment of virtual assets under Brazil’s foreign-exchange framework; and

4. Other relevant provisions introduced by the BCB Resolutions.

¹The press conference was broadcast live on YouTube, available at this link.

1. REGULATORY DEFINITIONS OF ENTITIES AND SERVICES

Concept | Regulatory Definition |

Virtual Assets | Digital representation of value that can be traded or transferred electronically and used for making payments or for investment purposes.² |

Virtual Asset Services | • Intermediation (purchase, sale, or exchange on behalf of third parties); and

• Custody. |

Virtual Asset Service Providers (“VASPs”) | • Virtual Asset Service Provider Companies (“VASPCs”), which operate exclusively in the virtual-asset segment (brokerage, custody or combination of both); or • Institutions already licensed that conduct virtual-asset activities. |

Virtual Asset Market Makers | Institutions or entities acting on their own account (under contract with a VASP), continuously posting buy and sell offers within the VASP’s trading environment to promote liquidity. |

Virtual Asset Liquidity Providers | Institutions acting on their own account, primarily dealing with institutional investors and VASPs, to provide market liquidity. |

Relevant Services | Custody, liquidity provision, and technology services directly related to virtual asset activities that may affect the VASP’s performance or clients’ rights. |

²Law No. 14,478/2022 is applied exclusively to virtual assets used for payment or investment purposes, and does not cover fiat currency, electronic money (such as credit cards or prepaid accounts), utility tokens, or securities.

2. AUTHORIZATION PROCESS

FOR NEW ENTRANTS:

Entities planning to start virtual asset services after the new rules take effect (February 2, 2026) must obtain authorization from the BCB.

Key authorization requirements include:

a. Demonstration of financial and economic capacity of controlling shareholders, including lawful origin and sufficiency of funds;

b. IT infrastructure adequate to the size, complexity, and risk profile of custody and intermediation activities;

c. Fit-and-proper assessment of officers, controlling shareholders, and senior management;

d. Corporate governance framework, including compliance, risk management, AML/CFT, and cybersecurity policies; and

e. Dedicated physical headquarters, prohibiting the use of shared offices or virtual addresses.

Minimum capital requirement: between BRL 10.8 million and BRL 37.2 million, depending on the range of activities to be performed.

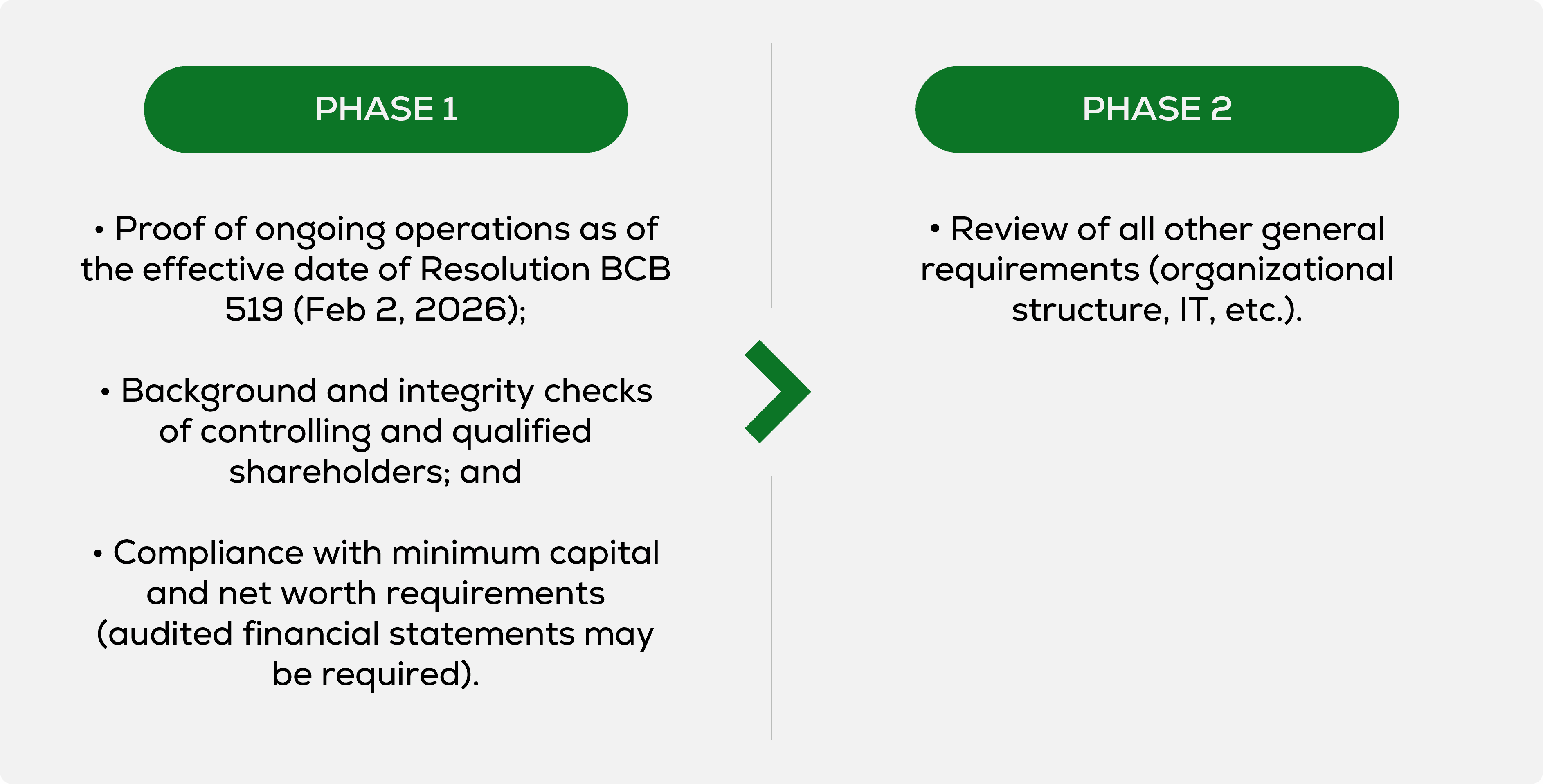

FOR EXISTING ENTITIES:

Active VASPs must submit their licensing applications by November 2027 ³

³The deadline is 270 days (nine months) from February 2, 2026, the effective date of BCB Resolutions 519 and 520.

VASPs applying within the deadline can keep operating while awaiting BCB’s decision but cannot add new services during this period.

If the application is rejected or archived, the entity must cease operations within 30 days.

FOR FOREIGN ENTITIES

Foreign VASPs offering services in Brazil will have 270 days to either:

A. Incorporate a local entity and seek authorization; OR

B. Transfer their operations and client base to an already licensed institution in Brazil.

FOR OTHER LICENSED INSTITUTIONS

Other institutions already authorized by the BCB, namely: (I) commercial, multiple, investment, and foreign-exchange banks, and (II) broker-dealers and distributors (CTVMs and DTVMs), are eligible to provide virtual-asset intermediation and custody services.

➜ Institutions not yet active in the virtual-asset market must notify the BCB of their intent and may only begin operations 90 days after such formal notice.

➜ Institutions already engaged in such activities must formally notify the BCB within 270 days from February 2, 2026.

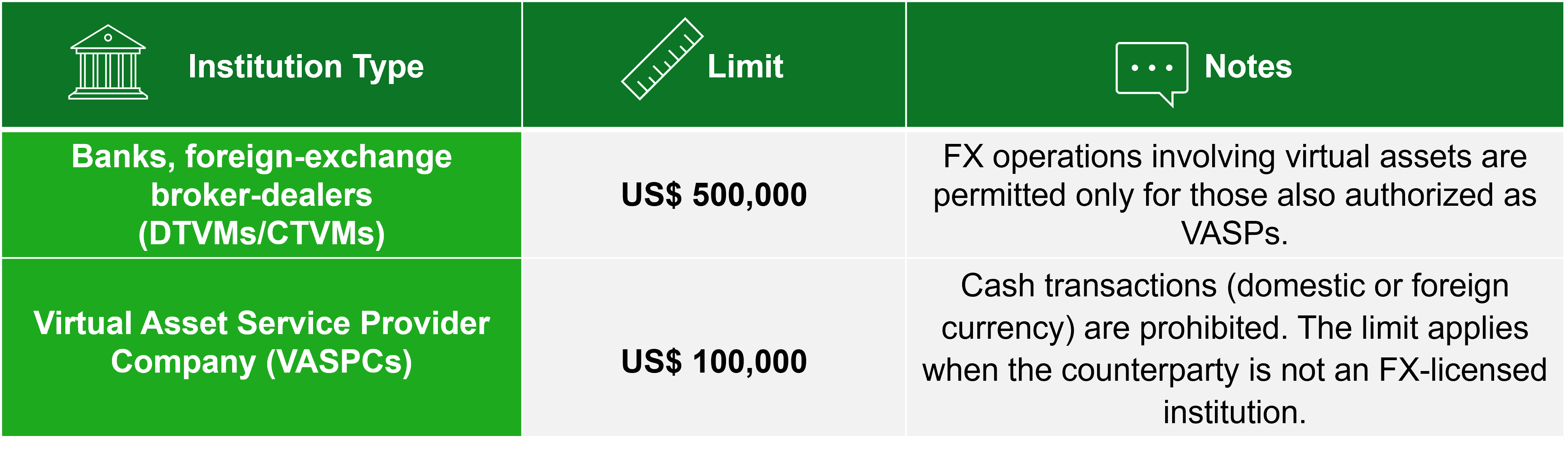

3. FOREIGN-EXCHANGE MARKET

Only VASPs authorized to operate in the FX market can handle virtual-asset-related foreign-exchange transactions, subject to limits.

IMPORTANT: Active VASPCs must include a specific request to engage in FX operations when applying for authorization.

Cross-Border Capital Implications:

➜ Virtual assets held abroad by Brazilian residents must be reported in the Annual Declaration of Brazilian Capitals Abroad (CBE);

➜ Capital contributions made in virtual assets must be disclosed in the Foreign Direct Investment (IDE) reporting;

➜ External credit operations in stablecoins must be registered in the SCE-Credit system based on the reference fiat currency value.

OBS.: The new reporting rules on FX and cross-border capital operations will become effective on May 4, 2026.

4. OTHER RELEVANT PROVISIONS

a) Ban on Algorithmic Stablecoins:

A formal prohibition applies to the offering, listing, or intermediation of fiat-referenced virtual assets whose reserve or backing mechanisms rely on algorithms.

Institutions already offering such products may allow clients to retain existing positions, but must discontinue the related services.

b) Asset Segregation and Client Protection:

VASPs must maintain full segregation between proprietary and client assets.

BRL-denominated funds must be held in individual prepaid payment accounts, legally protected from attachment or seizure in case of insolvency.

Virtual asset holdings must be recorded in segregated ledgers with mechanisms ensuring traceability and individualization of client wallets. Therefore, the use of “omnibus accounts” is expressly prohibited.

During the Press Conference, the BCB emphasized that the full legal recognition of asset-segregation mechanisms for virtual assets depends on the approval of a specific bill currently under review in the Brazilian Congress.

- More information

- Banking and Payments